AusGroup Limited (‘AusGroup’ or the ‘Group’) today announced its results for the three months ended 30 June 2018 (‘Q4 2018’), delivering its highest revenue in five years with a net profit of AU$13.5m.

Q4 FY2018 highlights

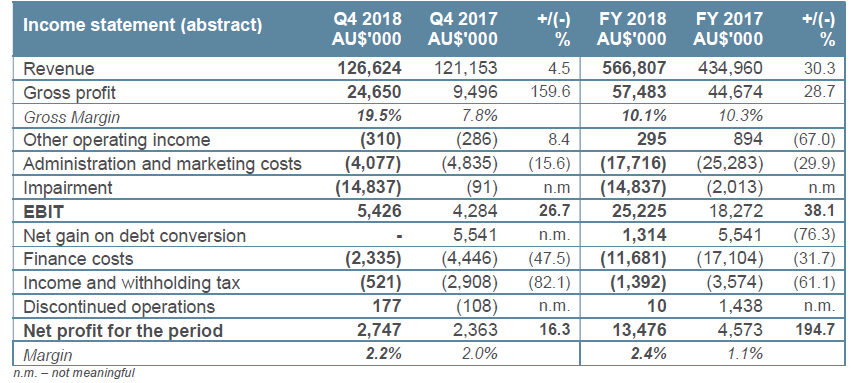

- Seventh consecutive profitable quarter with EBIT of AU$5.4m contributing to a full year EBIT of

AU$25.2m. - Increased level of revenue at AU$126.6m for the quarter and AU$566.8m for the full year (up 30.3%

on FY2017). - Increased gross profit in the quarter of AU$24.7m contributing to a full year gross profit of

AU$57.5m. - Balance sheet continues to strengthen as net debt decreases by AU$33.7m since June 2017.

- Net worth increases by AU$18.4m for FY2018 to AU$41.7m in June 2018.

Chief Executive Officer and Executive Director Shane Kimpton said “AusGroup has had a transformational year achieving excellent financial results from an increased revenue base. Our outstanding performance supports the long-term future of our business, allowing us to capitalise on our improved position as we continue to secure opportunities.

We have strengthened our senior leadership team, who will be delivering on our business strategy with the support of our exceptional employees. Our agile approach ensures we provide cost effective solutions without compromising on our excellent safety performance.

We are seeing a healthy demand of opportunities across the resource and energy sectors aligned with improving levels of investment, which are positive signs for the year ahead.”

AusGroup has reported net profit after tax of AU$2.7m which is an improvement on the corresponding period of Q4 FY2017 by 16.3%, due to the robust performance by the Group’s core projects in the energy and mineral process sectors and is after non-cash impairments of AU$14.8m required primarily to reduce the carrying value of the Group’s scaffolding asset base following completion of major project work as well as some restructuring provisions. EBIT for the quarter after non-cash impairments increased to AU$5.4m contributing to FY2018 EBIT of AU$25.2m, an increase of 38.1% on FY2017.

The debt servicing levels have continued to decrease over FY2018 with the Q4 FY2018 finance cost of AU$2.3m increasing the overall finance costs to AU$11.7m, a reduction of 31.7% compared to FY2017, mainly due to the repayment of loan facilities and the successful debt to equity conversion completed in Q2 FY2018. For the first time in five years AusGroup’s net profit after tax has been greater than the financing costs for the financial year.

Operational performance

Revenue for the quarter was AU$126.6m an increase of 4.5% compared to the corresponding period of Q4 FY2017, a modest growth following AusGroup’s major project work decreasing during the quarter. The FY2018 revenue of AU$566.8m is 30.3% higher than FY2017, due to the overall strong performance from the energy and mineral process sectors work. This represents the highest revenue for the Group for five years.

Gross profit for the quarter was AU$24.7m, an increase of 159.6% from the corresponding period of Q4 FY2017 due to cost efficiencies on existing projects and the release of project provisions. The FY2018 gross profit increased to AU$57.5m, an increase of 28.7% compared to FY2017.

Administration, marketing and other costs in the quarter were AU$4.1m, representing a 15.6% decrease from the corresponding period of Q4 FY2017 due to the effect of cost recoveries and operational efficiencies from project work and similarly these expenses for the full year have reduced by 29.9% compared to FY2017.

During Q4 FY2018 parts of the business were restructured due to the completion of major project work in order to right size the business which has resulted in non-cash impairments and restructuring provisions of AU$14.8m.

Financial position

Cash and cash equivalents for the Group as of30 June 2018 have increased by 11.8% to AU$37.9m as the profits from major projects convert to cash, partially offset by debt servicing payments and providing working capital to support the growth of the fuel service offering in the NT Port and Marine business.

Net borrowings have reduced by AU$33.7m since the end of FY2017 to AU$83.1m, predominantly due to the full repayment of the short term bridge loan and the full repayment of the short-term loan for a total of AU$27.4m. A further reduction of the Notes debt of AU$5.2m following another successful debt to equity conversion completed in Q2 FY2018 accounts for the balance.

Total shareholders’ equity as of 30 June 2018 has improved by 79.1% to AU$41.7m, demonstrating the benefits of the consistent profitability achieved for the previous seven quarters, together with the share capital issued from the debt to equity conversion in Q2 FY2018.

NT Port and Marine (NTPM): The fuel services business has moved from a commissioning phase into operations and now is delivering core services in the fuel sale market and the woodchip market.

Summary

This has been a successful year for AusGroup with a strong financial performance as evidenced in the profit after tax of AU$13.5m on a revenue of AU$566.8m, our highest turnover for five years. These results are based on the hard work and contribution from our employees across all sectors of the business, working safely under sometimes challenging conditions whilst producing a high quality of work for our clients.

The strengthening in our balance sheet to improve the net worth position to AU$41.7m as a result of reducing bank debt and another successful debt to equity conversion is rewarding and illustrates the conversion of earnings to cash to enable these payments to be made.

Our work in hand has decreased to AU$230m as of 30 June 2018, following the completion of major projects in the energy sector and, as a result, the business has undertaken some restructure in the year so that the overall business is positioned for success. This restructure resulted in non-cash impairments of AU$14.8m.

The strong Q4 FY2018 results represent the seventh consecutive quarter of profitability. The key focus for the Group is still on safe working, operational delivery excellence and building a solid pipeline of new work.

Background information

AusGroup offers a range of integrated service solutions to the energy, resources, utilities, port & marine and industrial sectors. Our diversified service offering supports clients at all stages of their asset development and operational lifecycle.

Through subsidiaries AGC, MAS & NT Port and Marine, we provide maintenance, construction, access services, fabrication and marine services. With over 29 years of experience, we are committed to helping our clients build, maintain and upgrade some of the region’s most challenging projects.

This release should be read in conjunction with our SGX Announcement.

Issued by AusGroup Limited.