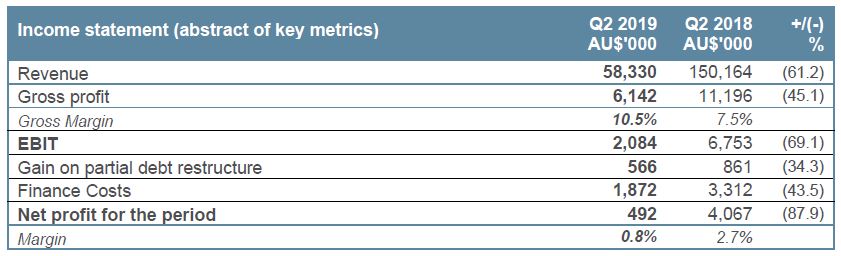

AusGroup Limited (‘AusGroup’ or the ‘Group’) today announced its results for the three months ended 31 December 2018 (‘Q2 2019’), with another profitable quarter of AU$0.5m and revenue of AU$58.3m.

Q2 FY2019 highlights

- Another profitable quarter with Profit from operations (EBIT) of AU$2.0m and margins of 3.6%.

- Strengthened balance sheet with net worth at AU$95.9m following re-financing.

- Fund raising activities completed in the quarter with AU$46.8m raised through share placement and rights issue providing AusGroup with working capital.

- Partial repayment of external debt with Noteholders of AU$21.8m utilising proceeds from funding activities. The restructuring of the Group’s debt will reduce the interest servicing costs in H2 FY2019.

- New investors have injected significant funds and now have substantial holdings in AusGroup, replacing Ezion Holdings as principal shareholder.

- Revised Board of Directors with two Non-Executive, Non-Independent directors appointed in the quarter.

Chief Executive Officer and Executive Director Shane Kimpton said, “In the last quarter, the re-financing of the long-term debt with our Noteholders has been successfully completed resulting in the financial position of the Group being the best it has for over three years. Our net worth has improved by AU$54.2m in the last quarter and now stands at AU$95.9m. The working capital injection received through the funds raised under the share placement and rights issue has significantly improved the current liquidity as the debt has been extended for four years at vastly reduced interest rates.

It is particularly pleasing to note our ninth successive profitable quarter with a modest profit of A$0.5m underpinning the stability in the business as we improve our order book which is now diversified across all sectors.

On 19 December 2018, the Group announced the completion of a rights issue and share placement which raised S$46.4m (AU$46.7m) with S$29.2m (AU$29.4m) being used to retire debt and S$17.2m (AU$17.3m) being injected as working capital. The Group welcomed new investors who now hold a significant stake in the company and have appointed two new Directors bringing a wealth of experience and knowledge to the business. The two new directors are Non-Executive and Non-Independent appointments.

The Lithium based projects have continued well in the quarter with further scope increase on the current projects agreed with respective clients. The substantial influx of capital investment into the Australian lithium sector through the construction of new mines and lithium process plants is expected to provide significant project opportunities for AusGroup over the next few years.

There is a renewed optimism now after the re-basing of our debt and the injection of working capital which enables AusGroup to pursue new work on an equitable basis to our competition. In the short term however there will still be a challenging environment until the emergence of the key work prospects being pursued in H2 2019 are converted to work in hand.

The safety record across the business in the second quarter has been excellent as we embarked on the roll out of the critical control management program. AusGroup will continue to deliver projects to the highest performance levels of safety and quality as we diversify our portfolio of contracts.”

AusGroup has reported net profit after tax of AU$0.5m, which is lower than the comparative quarter mainly due to the completion of major projects in FY2018.

Revenue for the Q2 2019 decreased by 61.2% quarter on quarter (QoQ) to AU$58.3m (Q2 2018: AU$150.2m) as a result of the completion of major project work in the previous period and timing delays in anticipated new work.

Gross profit decreased by 45.1% QoQ to AU$6.1m in Q2 2019 (2Q 2018: AU$11.2m) again due to the drop in activity following the completion of the major projects in the comparative period. However, the gross margin of 10.5% in the quarter is at the top end of the Group’s range of 7.0% to 10.0% and is significantly higher than in the comparative quarter (Q2 2018: 7.5%) demonstrating the quality in the earnings from our project portfolio.

EBIT for the quarter is less than the prior year’s comparative quarter earning 3.6%, a decrease QoQ of 69.1% for the reasons outlined above.

Following the completion of the debt re-financing mentioned previously, the level of finance costs have reduced by 43.5% when compared to the previous period reflecting the reduction in the interest rates for the long term debt.

Financial position

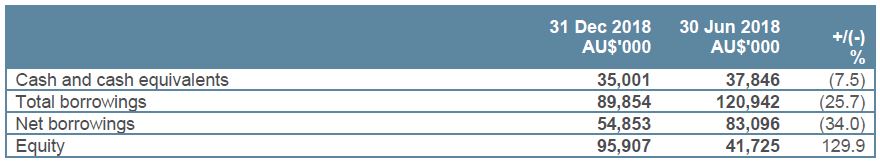

Cash and cash equivalents: Cash and bank balances decreased 7.5% by AU$2.8m to AU$35.0m on31 December 2018 (30 June 2018: U$37.8m), maintaining a consistent level of cash in hand since the start of the financial year. The proceeds from the share placement and rights issue resulted in an injection of approximately AU$17.3m in working capital (net of debt repayments) which alleviates delays in cash receipts from current project activities.

Net borrowings have reduced by AU$28.2m since 30 June 2018 to AU$54.9m a drop of 34.0%, reflecting the partial repayment of the principal on the Noteholder debts and reduction in the long-term bank debt in the last quarter.

Total shareholders’ equity as of 31 December 2018 has improved by 129.9% to AU$95.9m, an increase of AU$54.2m, which results from the increase in share capital following the completion of the fund raising activities under the share placement and rights issue.

Summary

The second quarter results complete the ninth successive quarter of profitability indicating an underlying consistency in the operational performance levels across the Group. The completion of the re-financing is a major highlight for the Group and positions the business in the strongest financial state for over three years. Numerous opportunities will present in the next quarter and into the next financial year so this financial stability will enable the Group to compete on par with our peers to secure some of this work.

Our work in hand has increased slightly to AU$167m as of31 December 2018, which is consistent with the previous quarter (Q1 2019: AU$165m). There has been organic growth from existing contracts that has helped to keep the work in hand levels consistent, with expected growth to come from further organic growth and renewal of current contracts. The conversion of key pursuits is our main focus for the next period and to still focus on safe working, operational delivery excellence and building a solid pipeline of new work.

Background information

AusGroup offers a range of integrated service solutions to the energy, resources, utilities, port & marine and industrial sectors. Our diversified service offering supports clients at all stages of their asset development and operational lifecycle.

Through subsidiaries AGC, MAS & NT Port and Marine, we provide maintenance, construction, access services, fabrication and marine services. With over 29 years of experience, we are committed to helping our clients build, maintain and upgrade some of the region’s most challenging projects.

This release should be read in conjunction with our SGX Announcement.

Issued by AusGroup Limited.