AusGroup continues consecutive profits – AU$1.3m net profit

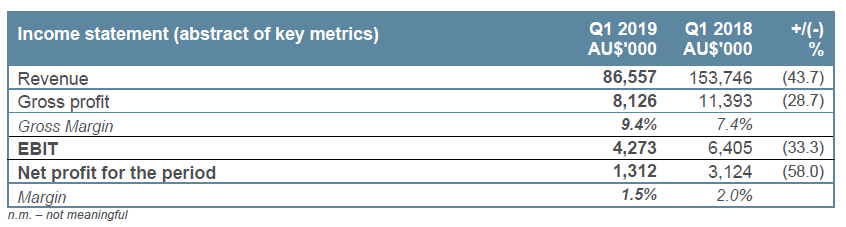

AusGroup Limited (‘AusGroup’ or the ‘Group’) today announced its results for the three months ended 30 September 2018 (‘Q1 2019’), with another profitable quarter of AU$1.3m and revenue of AU$86.6m.

Q1 FY2019 highlights

- Another consecutive profitable quarter (2 years of consistent profits) with EBIT of AU$4.3m and margins of 4.9% consistent with the comparative quarter, demonstrating strength in underlying operational earnings base.

- Revenue for the quarter of AU$86.6m from a diversified portfolio of clients.

- The delivery of multiple construction contracts in the lithium sector has positioned AusGroup as one of the largest lithium construction contractors in Australia.

- Finance costs are 19% lower QoQ to the comparative quarter—with the full effect of the debt-to-equity exercises completed in FY18 now evident.

- Balance sheet has improved and stabilised—Noteholder extension now approved in the quarter—will reduce net debt further and further strengthen the balance sheet in Q2 FY19.

Chief Executive Officer and Executive Director Shane Kimpton said “AusGroup has followed last year’s performance with a very good start to the year, producing a solid set of financial results earned from a more diversified client portfolio. All sectors have performed well in the first quarter with excellent progress being made and it is particularly pleasing to see the growth in the lithium based projects in the first quarter as strategically this plays an important role for the business over the rest of the year and beyond.

It is encouraging to deliver positive results in Q1 FY2019 as we embark on the transformational restructure of our financing base comprising the share placement, rights issues and restructure of the multi-currency notes in Q2 FY2019. This strengthening of the financing structure positions the business to capitalise on new opportunities and enable AusGroup to continue on the growth trajectory.

The safety record in the first quarter has been excellent whilst we have many new projects starting, we maintain our goals to ensure that we deliver our projects to a high level of quality without compromising our excellent safety performance.”

AusGroup has reported net profit after tax of AU$1.3m which although lower than last year’s comparative, mainly due to the completion of major projects in FY 2018, the underlying margins have been consistent YoY and is within the range 1.5% to 2.0%.

Revenue of AU$86.6m and gross profit of AU$8.1m demonstrate underlying strength in the operational earning base, whilst margins are well within the Group’s range of 7.0% to 10.0% on the back of solid performances from the main contracts in our maintenance and projects’ business units. EBIT for the quarter is also consistent with the prior year’s comparative quarter earning 4.9%, an increase YoY of 16%. The debt servicing levels have reduced 19% from the comparative quarter as the full effect of the debt-to-equity exercises completed in FY2018, results in reduced debt servicing levels.

Summary

The new financial year has started well and has provided the platform for AusGroup to produce another good year’s results on the back of the diversified project portfolio. The opportunities that will present over the ensuing periods will provide the basis for growth in line with the strategic intent outlined by the business.

Our work in hand has decreased to AU$165m as on30 September 2018, however there are a number of key contract pursuits that will convert in the next quarter(s) along with organic growth from our existing portfolio that will increase the order book and provide the platform for continuing success. The key focus for the Group is still on safe working, operational delivery excellence and building a solid pipeline of new work.

The strengthening in our balance sheet that will occur after the restructure of the external Note debt in Q2 FY2019, will also provide strength to our tendering strategy in order to secure more work.

Background information

AusGroup offers a range of integrated service solutions to the energy, resources, utilities, port & marine and industrial sectors. Our diversified service offering supports clients at all stages of their asset development and operational lifecycle.

Through subsidiaries AGC, MAS & NT Port and Marine, we provide maintenance, construction, access services, fabrication and marine services. With over 29 years of experience, we are committed to helping our clients build, maintain and upgrade some of the region’s most challenging projects.

This release should be read in conjunction with our SGX Announcement.